Newsfeed Categories

Community CornerFundingNew York StateNew York CityFederalResearchPressMember NewsOpeningsGroundbreakingsNetwork Events

Medicaid Redesign Team - Using state medicaid dollars for supportive housing

Oct.01.2018

In 2012, as part of the state’s comprehensive strategy to reduce costs and improve care of the state’s Medicaid program, the Department of Health established the Medicaid Redesign Team (MRT) Supportive Housing Program. This was the first time in the country, a state used Medicaid funding from the state’s Medicaid cap to fund supportive housing.

NYS Department of Health (DOH) established a $75 million annual commitment to expand supportive housing for high cost/high need Medicaid recipients and the state Legislature adopted and funded the state’s first ever MRT Supportive Housing Program to provide service funding, rent subsidies and capital dollars to create supportive housing for high-cost Medicaid recipients.

Since its inception in 2012, the program has continued to grow with state general fund dollars from $75 million in 2012 to $107 million today. The financial support for this program comes solely from funding under the State’s Medicaid cap within DOH’s general fund budget. This funding has supported supportive housing capital programs, services and operating funding for both supportive and long term care programs, nine pilot programs to support potential interventions to reduce Medicaid costs and tracking and evaluation programs.

To date, 53 congregate supportive housing projects with approximately 1,907 units of supportive housing have been funded with a portion of the resources coming from the MRT Supportive Housing Program. In each of these projects MRT funding constituted part of the projects’ overall funding, blending MRT funds with other state and/or local resources.

The MRT program also funds 3,117 scattered site supported housing units across the state for formerly homeless individuals struggling with either mental illness, substance use disorders, HIV/AIDS, or other chronic medical conditions, or those who are transitioning from an institutional setting throughout New York State Since 2012, over 12,000 individuals have been served.

Read profiles of the first two supportive housing projects created with MRT Supportive Housing Capital, Son House Apartments in Rochester and Creston Avenue Apartments in the Bronx.

Click here to see State Medicaid Director and leader of the MRT, former Medicaid Director, Jason Helgerson, discuss the program at our 2012 Annual Conference.

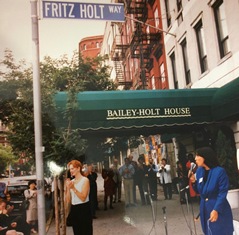

Bailey-Holt House- The first supportive housing for those living with HIV/AIDS

Sep.28.2018

No other city felt the AIDS crisis more deeply than New York City. New York City was the first city in North America to have confirmed infections and by the mid-1980s, nearly 2,000 New Yorkers had died from AIDS and another 1,800 had been diagnosed. The most affected by the illness were those who at the fringes of society. Due to discrimination, gay men, intravenous drug users, and people of color provoked little sympathy or support from the public or financial support from the government. Meanwhile, for those who were living with AIDS, the costs of medication, the physical toll, and discrimination and stigma around the disease made maintaining housing extremely difficult. As a result, a number of those living with HIV/AIDS became homeless.

No other city felt the AIDS crisis more deeply than New York City. New York City was the first city in North America to have confirmed infections and by the mid-1980s, nearly 2,000 New Yorkers had died from AIDS and another 1,800 had been diagnosed. The most affected by the illness were those who at the fringes of society. Due to discrimination, gay men, intravenous drug users, and people of color provoked little sympathy or support from the public or financial support from the government. Meanwhile, for those who were living with AIDS, the costs of medication, the physical toll, and discrimination and stigma around the disease made maintaining housing extremely difficult. As a result, a number of those living with HIV/AIDS became homeless.

In 1983, the AIDS Resource Center was founded. Later renamed Bailey House, the AIDS Resource Center had a particular focus on the importance of housing for people living with AIDS. The AIDS Resource Center created an innovative model, its Supportive Housing Apartment Program (SHAP). SHAP brought supportive services to the homes of people living with AIDS and helped them to maintain stability in their lives. This was the nation's first scattered site housing for people living with HIV/AIDS; it created a model of supportive housing that has since been replicated internationally.

In the face of mounting public pressure from groups like Gay Men’s Health Crisis and the AIDS Resource Center, in 1985, under Mayor Ed Koch, the Human Resources Administration created the Division of AIDS Services and Income Support (DASIS), which later became the HIV/AIDS Services Administration (HASA). DASIS provided rental vouchers for homeless and very low-income New Yorkers with AIDS, enabling them to bypass the shelter system and access housing, affordable or supportive, directly.

In 1986, with the support of the Koch and Cuomo administrations, the AIDS Resource Center opened Bailey-Holt House, the nation’s first congregate residence for people living with AIDS. This program became a shining example, proving that stable, supportive housing helped people with AIDS maintain their health and dignity, and led to housing becoming a demand of AIDS activists in New York City and around the nation. Today, Bailey House operates housing for nearly 700, women and children across New York City.

In 1990, the Federal government created the Housing Opportunities for People with AIDS (HOPWA) program in the AIDS Housing Opportunities Act, a part of the Cranston-Gonzales National Affordable Housing Act of 1990. HOPWA provided housing assistance and supportive services for low-income and homeless people living with HIV/AIDS, and their families. This was the first significant federal funding for HIV/AIDS housing, and this funding stream continues to be a vital source of services dollars nationally.

As public understanding of the disease increased, the programs to support those with HIV/AIDS gained broader public support. In NYC, the dedicated nonprofit community, including Housing Works, Harlem United, Bailey House, Volunteers of America of Greater New York, Comunilife, and others, continued to construct congregate supportive housing for people living with HIV/AIDS with the help of the City’s Supportive Housing Loan Program, and state Homeless Housing Assistance Program (HHAP) funding. In 2007, the NY/NY III agreement provided a new dedicated source of services funding from the City and State for new congregate and scattered site housing for people living with HIV/AIDS.

In 2016, in a program called “HASA for All,” Governor Andrew Cuomo announced that low-income residents of NYC who are HIV-positive but asymptomatic would be able to access the same assistance as low-income residents who show symptoms. About 6,500 to 7,000 additional people are now able to benefit from the expansion of HASA, which now serves about 32,000 people.

In 2016, in a program called “HASA for All,” Governor Andrew Cuomo announced that low-income residents of NYC who are HIV-positive but asymptomatic would be able to access the same assistance as low-income residents who show symptoms. About 6,500 to 7,000 additional people are now able to benefit from the expansion of HASA, which now serves about 32,000 people.

To this day, nonprofits in NYC and NYS continue to develop supportive housing to ensure that people living with HIV/AIDS have access to high quality homes and the services they need to maintain their lives in stability and dignity.

Low Income Housing Tax Credit- a financing innovation to help build more supportive housing

Sep.27.2018

The Low Income Housing Tax Credit (LIHTC) was created in 1986 under President Reagan and made permanent in 1993 under President Clinton, around the same time that the supportive housing model was scaling up in New York. (The first New York/New York agreement was signed in 1990). Created through the federal Tax Reform Act, LIHTC ushered in a new era of affordable and supportive housing development, one that engaged and expanded the field of stakeholders and leveraged private investment.

What is the Low Income Housing Tax Credit?

The Low Income Housing Tax Credit is an indirect federal subsidy for low-income affordable rental housing. The program, administered by the U.S. Department of Treasury, acts as an incentive to private developers and investors to provide low-income housing. LIHTC provides a dollar-for-dollar credit against federal income tax liability, meaning for every tax credit you claim, you can reduce your federal tax bill by one dollar. Investors make a cash contribution, which functions as equity for a real estate deal, in exchange for future allocation of tax credits.

Pools of LIHTC are allocated to states based on a federal formula. In New York, NYS Homes and Community Renewal (HCR) and NYC Department of Housing Preservation and Development (HPD) have the authority to provide tax credits according to local priorities.

How does it help create supportive housing?

Before the Low Income Housing Tax Credit, supportive housing was entirely financed by grants and subsidized loans from the government. By enabling public-private partnerships, LIHTC brought new resources to the table.

In the early 1990s, LIHTC was first used to finance the rehabilitation of nine buildings in New York City to become supportive housing for low-income individuals and those who had experienced homelessness. In a process known as syndication, National Equity Fund and Enterprise helped nonprofit developers access LIHTC and connect their projects to investors.

LIHTC Today

Today, LIHTC helps finance the majority of supportive housing in New York State. 73% of the residences that opened in 2017 used the credit. The Network and our partners are deeply involved with efforts to expand and strengthen the program, including advocating that Congress pass the Affordable Housing Credit Improvement Act.

Housing First- innovation to reduce chronic homelessness

Sep.26.2018

Housing First is a unique approach to provide housing to those who have been chronically homeless without any preconditions of sobriety, treatment programs or service participation. Watch Kevin O'Connor, Executive Director at Joseph's House & Shelter, discuss the success of this approach in supportive housing.

Supportive Housing Loan Program- A unique innovation to finance housing for homeless New Yorkers

Sep.25.2018

The world-renowned HPD Supportive Housing Loan Program (SHLP)– a one-stop shop that provides loans to develop supportive housing in New York City – had humble beginnings. It was started in 1988 and combined the Capital Budget Homeless Housing Program (CBHHP) and the Single Room Occupancy (SRO) Loan Program which at the time was financing the renovation of commercial SROs. Under Tim O’Hanlon during his time at the New York City Department of Housing Preservation and Development (HPD), the newly imagined SRO Loan Program grew to be the primary program the City uses to house chronically homeless New Yorkers.

The early Supportive Housing Loan Program (then SRO Loan Program) projects were exclusively existing buildings. The program either renovated or rehabilitated the buildings so that 60% of the apartments served people in need of both housing and onsite services – such as formerly homeless individuals coping with behavioral health issues – and 40% of the apartments were designated for low-income individuals from the community. The supportive/affordable mix had numerous benefits including creating or preserving affordable housing, providing a community benefit, and ensuring buildings were integrated.

The early Supportive Housing Loan Program (then SRO Loan Program) projects were exclusively existing buildings. The program either renovated or rehabilitated the buildings so that 60% of the apartments served people in need of both housing and onsite services – such as formerly homeless individuals coping with behavioral health issues – and 40% of the apartments were designated for low-income individuals from the community. The supportive/affordable mix had numerous benefits including creating or preserving affordable housing, providing a community benefit, and ensuring buildings were integrated.

Another key element of the Program was its reliance on nonprofits: “When the City started to try to develop homeless housing on its own, parallel to CBHHP, there was too much community resistance. But when local nonprofits developed, the community went for it. They liked the accountability and the accessibility; the organizations were right there in their communities already,” said Tim O’Hanlon, Vice President, Hudson Housing Capital and Former Assistant Commissioner of Special Needs Housing, HPD.

Emily Lehman, current Assistant Commissioner of Special Needs Housing, adds,“SHLP is really geared toward working with NFPs; this is a hallmark of what SHLP has always been about. The nonprofit advocate community created supportive housing in NYC, so we have tried to preserve their role to this day. One of the things that I really love about working in this program is that it feels like [the nonprofits and HPD] are all on the same team, working towards the same goal.” For-profit developers can now develop supportive housing if in joint venture with a nonprofit, further expanding the universe of actors who can work to bring supportive housing to fruition.

Emily Lehman, current Assistant Commissioner of Special Needs Housing, adds,“SHLP is really geared toward working with NFPs; this is a hallmark of what SHLP has always been about. The nonprofit advocate community created supportive housing in NYC, so we have tried to preserve their role to this day. One of the things that I really love about working in this program is that it feels like [the nonprofits and HPD] are all on the same team, working towards the same goal.” For-profit developers can now develop supportive housing if in joint venture with a nonprofit, further expanding the universe of actors who can work to bring supportive housing to fruition.

The Program allowed providers to take on massive projects, gut rehabbing dilapidated SROs and hotels, around the city, primarily in the Upper West Side and in the Times Square area. The largest project was the Times Square Hotel. Rosanne Haggerty, former Executive Director of Common Ground (now Breaking Ground) submitted an application to HPD seeking to rehabilitate the former hotel that had been used to provide degraded housing to up to 1,000 tenants becoming in what was known as a “welfare hotel” in the 1980s. Tim O’Hanlon remembers: “At the time no one was spending money to buy buildings. But the City agreed to give Common Ground $30 million to acquire the Times Square Hotel.”

The first completely newly constructed supportive housing residence was not built until the mid-1990s. Around the same time, the financing structure for supportive housing deals were beginning to diversify. SHLP funding was paired with 9% Low Income Housing Tax Credits for the first time. In 2018, HPD set-aside 40% of its 9% tax credits to fund supportive housing in New York City.

Former HPD Associate Commissioner Jessica Katz commented on the program’s flexibility and its role in building the capacity of the nonprofit development community: “Nowhere else is there a program for supportive housing that operates at this scale. One key aspect is that SHLP can operate both as a stand alone program as well as in concert with other mainstream affordable housing resources. This ensures a diversity of projects including smaller deals with smaller nonprofits as well as the ability to incorporate supportive housing within larger affordable housing projects. This builds capacity in the sector and encourages a wide variety of supportive housing options.”

Former HPD Associate Commissioner Jessica Katz commented on the program’s flexibility and its role in building the capacity of the nonprofit development community: “Nowhere else is there a program for supportive housing that operates at this scale. One key aspect is that SHLP can operate both as a stand alone program as well as in concert with other mainstream affordable housing resources. This ensures a diversity of projects including smaller deals with smaller nonprofits as well as the ability to incorporate supportive housing within larger affordable housing projects. This builds capacity in the sector and encourages a wide variety of supportive housing options.”

Since 1988, the Supportive Housing Loan Program and related historic HPD programs have produced over 19,000 supportive and affordable units.