The Damage is in the Details of HUD’s Proposed Rent Policy Changes

Jun.08.2018

Laura Mascuch, the Network's Executive Director co-authored with CEO of Breaking Ground, Brenda Rosen, an op-ed on the impact of HUD's new rent increase proposal.

Check it out: The Damage is in the Details of HUD’s Proposed Rent Policy Changes

Executive Budget for FY 2019 released

Feb.15.2018

The White House released its FY 2019 budget on Monday February 12, 2018. It largely repeats last year’s attempt by the executive branch to gut federal spending; a budget that was considered dead on arrival. This proposed budget ignores the increased spending limits for FY 2018 and 2019, signed by the president earlier this year. Worse, it would shift major costs to the states and to people in poverty, especially the working poor.

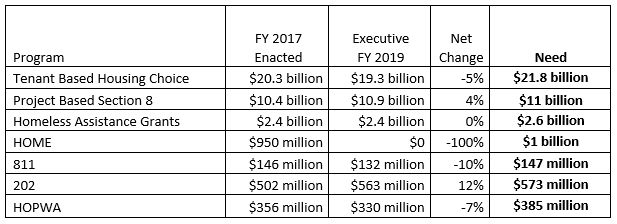

Below is a chart that shows how the FY 2019 executive budget compares to the enacted 2017 budget, as well as the Network’s recommendations for FY 2018 funding levels.

Note that the executive budget would eliminate both the HOME and CDBG programs, cutting $4 billion in block grant funding to states and localities, a $400 million loss in New York State.

Take Action:

The House and Senate continue to work on an omnibus budget bill for FY 2018, with a March 23rd deadline. We will report on the details if and when they become available. Meanwhile the FY 2019 budget process is moving forward. Please join the Network in calling on your member of Congress and ask them to sign on to three 'Dear Colleague' letters:

Rep Gwen Moore has sponsored a 'Dear Colleague' letter to fund the McKinney-Vento Homeless Assistance Grant at $2.8 billion. The deadline is March 16th. House Members my sign on here: talia.rosen@mail.house.gov.

Rep. Marcia Fudge is sponsoring a 'Dear Colleague' letter to fund the HOME Program at $1.2 billion in FY 2019. The deadline for Representatives to sign on is COB Tuesday, March 13. House offices can sign on using this link.

Rep. Jerrold Nadler is sponsoring a 'Dear Colleague' letter urging the THUD Subcommittee to support Section 8 funding at $22.8 billion. The deadline to sign is March 15th. Members can sign on by contacting: melissa.connolly@mail.house.gov.

You can call the congressional switchboard at (202) 224-3121 and ask to be connected to your member of congress.

Thank you for your advocacy and support!

Federal Tax Reform Preserves Private Activity Bonds

Dec.21.2017

Tax reform has now been passed by Congress and signed into law by the president. The Network has been focused primarily on the restoration of tax-exempt, private activity housing bonds (PABs), which were eliminated in the original House proposal. While the final bill will present challenges for supportive housing and its residents, we are happy to say that PABs were restored in the final version of the bill. This is important as PABs play a vital role in affordable housing development in conjunction with 4% as-of-right Low Income Housing Tax Credits (Housing Credits). This capital funding source has become increasingly important to supportive housing development over the past decade, and will be even more crucial to meet New York State’s supportive housing production goal of 1,200 units per year and New York City’s supportive housing production goal of 500 units per year.

For the past two months the Network has been active in gaining commitments from the majority party members to protect PABs and six of nine weighed in to support our cause: Reps. Donovan, Faso, Katko, King, Stefanik, and Zeldin. We thank them for their support.

The 9% Housing Credit is preserved and no additional amendments were added in the final bill. The 130% basis boost remains the same. However, by lowering the corporate tax rate from 35% to 21%, the bill is anticipated to have a negative effect on the value of the Housing Credit – decreasing it by approximately 14% – and projects will require additional capital funding to be made whole. Actions to ameliorate this impact were not included in the final bill, but the Network will be focusing on legislation to address the issue moving forward.

Finally, both Historic Tax Credits and New Markets Tax Credits were retained.

With tax reform behind us, we will focus our advocacy efforts on the budget, fighting to ensure that critical programs to provide affordable housing and end homelessness are not sacrificed. We anticipate that tax reform’s $1.4 trillion in budget shortfalls will trigger automatic spending cuts equal to $146 billion each year for ten years. If automatic cuts do in fact go into effect, there would be reductions across a range of programs including the Department of Housing and Urban Development (HUD) according to the Times.

Here is the full conference bill: http://docs.house.gov/billsthisweek/20171218/CRPT-115HRPT-466.pdf

Relevant news and analysis on the impact on affordable housing can be found on the ACTION Campaign’s website: http://rentalhousingaction.org/.

House’s Tax Reform Will Decimate Affordable/Supportive Housing Development

Nov.27.2017

(1).jpg)

Renaissance Village, affordable/supportive housing for homeless veterans on Long Island was developed with Private Activity Bonds that have been eliminated in House’s version of tax reform.

While both the Senate and House versions of tax reform would result in huge deficits that will impact all non-defense spending including homeless housing programs, the House bill (HR 1) that passed on November 16, would have a devastating impact on affordable and supportive housing by eliminating tax exempt private activity bonds (PAB). These bonds provide capital funding in conjunction with the 4% LIHTC. These credits are available as-of-right, and automatically qualify for PABs. They are responsible for about half of the affordable housing development across New York State.

While HR 1 preserves the 9% Low Income Housing Tax Credit (LIHTC), drastic proposed cuts to the corporate tax rate will erode the LIHTC’s value by an estimated 25%.

It is estimated that the state will lose $4.5 billion dollars and 17,000 units of affordable housing annually with these changes. Also eliminated are Historic Tax Credits and New Market Tax Credits, two valuable tools used to spur housing and community development.

The Network, along with a broad swath of affordable housing groups and housing agencies, immediately began advocating against HR1: We alerted our membership to share their opinions about the bill with their representatives; we put out a joint press release; and we published editorials defending the restoration of private activity bonds to the bill. We also led a series of key meetings in Washington, D.C. with several of the Republican representatives whose votes were in play.

In the end, all amendments to the bill were defeated along straight party lines. HR1 passed with 227 votes for, and 205 votes against, with only 13 Republicans voting against it. This group of Republican dissenters includes five New York State representatives: Donovan, Faso, King, Stefanik, and Zeldin, whose opposition was based primarily on the elimination of deductibility for state and local taxes. The PAB cuts are a concern that several of these representatives raised during a press conference explaining their votes. All Democrats voted against the bill.

The Senate Finance Committee introduced its own tax reform bill, after rejecting the House bill unanimously. This bill preserves the PAB, and the 9% LIHTC although, again, the drastic cut to corporate tax rates will lead to the same 25% devaluation of tax credits. It will only require a majority to pass in the Senate, which is closely divided. Both New York Senators are opposed, as are the rest of the Democrats. This bill passed out of the Finance Committee and will face fierce debate on the senate floor. A vote is expected after Thanksgiving recess. If this competing bill passes, the House and Senate will form a reconciliation committee to produce a final version of the bill.

Attempts are also being made to improve both versions of the bill, by addressing the loss of value to the 9% LIHTC, and by adding provisions of the Cantwell-Hatch bill that would improve the efficiency of the program. Some of these provisions may make it into the final Senate bill. Unless the Senate bill fixes the loss in valuation of the credit, there will be a significant loss of capacity to develop affordable and supportive housing.

In other news, The FY 2018 budget has yet to be resolved. At the beginning of the tax reform process the House agreed to the Senate’s higher overall budget numbers, to allow for the Senate to vote on tax reform under reconciliation, which requires a simple majority. In general, the last Senate HUD budget proposal, was the most favorable to supportive housing with modest increases to McKinney and Section 8, and flat funding in other key programs. The final budget details have not been formalized and another short term continuing resolution is expected, as the current CR expires December 8.

The Network will continue to work with our local affordable housing partners and our national partners, including the ACTION Coalition, National Alliance to End Homelessness and the National Low Income Housing Coalition to fight for increased resources for affordable and supportive housing.

Federal Budget Update

Aug.03.2017

Within the past month, the House appropriations committee proposed flat-funding Department of Housing and Urban Development (“HUD”) programs for Fiscal Year 2018, while the Senate committee modestly increased HUD funding levels. These two proposals serve as starting points for budget negotiations between the two houses of Congress. Since none of the other budget committees have put forth proposals, it is unlikely that there will be further action on the Federal budget before the end of the fiscal year.

Within the past month, the House appropriations committee proposed flat-funding Department of Housing and Urban Development (“HUD”) programs for Fiscal Year 2018, while the Senate committee modestly increased HUD funding levels. These two proposals serve as starting points for budget negotiations between the two houses of Congress. Since none of the other budget committees have put forth proposals, it is unlikely that there will be further action on the Federal budget before the end of the fiscal year.

On July 17-19, one week after the House released their budget proposal, the Network joined forces with the National Alliance to End Homelessness to make 25 lobby visits with 40 advocates from across New York State. These meetings covered a variety of budget concerns as well as legislative issues. Members of the New York delegation were particularly supportive of the Tiberi-Neal Affordable Housing Credit Improvement Act. (The program is also referred to as the Low Income Housing Tax Credit (“LIHTC”) program). One of the many provisions of the legislation would allow for income averaging in LIHTC developments to help reach lower income tenants.

Thanks to all who participated and special thanks to our talented Princeton intern, Marcia Brown, who organized a special meeting, attended by both New Yorkers and Ohioans, with the Senate Banking Committee.

Our Homes, Our Voices - National Housing Week of Action, July 22-29

Jul.20.2017

.png)

The House appropriations committee has approved a Transportation, Housing and Urban Development budget bill for FY 2018 that endangers desperately needed housing and homelessness programs. There is still time to influence members of Congress as the budget process continues in the coming weeks and months. See more about our current federal budget and policy priorities here.

Continue Reading …Executive Budget Proposes Devastating 15% Cuts to HUD

May.24.2017

On May 23rd, President Trump released his first budget proposal for FY 2018, which begins October 1, 2017. While it provides more detail than the “skinny budget” short-form budget released in March, it slashes domestic spending dramatically and HUD programs are specifically under attack. Whole block grant programs (which are critical to the production of supportive housing), including Community Development Block Grant and HOME Investment Partnerships are eliminated, along with the Interagency Council on Homelessness. It also strips funding from the National Housing Trust Fund, funding specifically targeted to building affordable housing to the nation’s poorest households. The Veterans Affairs Supportive Housing (VASH) receives no new vouchers in the president’s budget proposal.

On May 23rd, President Trump released his first budget proposal for FY 2018, which begins October 1, 2017. While it provides more detail than the “skinny budget” short-form budget released in March, it slashes domestic spending dramatically and HUD programs are specifically under attack. Whole block grant programs (which are critical to the production of supportive housing), including Community Development Block Grant and HOME Investment Partnerships are eliminated, along with the Interagency Council on Homelessness. It also strips funding from the National Housing Trust Fund, funding specifically targeted to building affordable housing to the nation’s poorest households. The Veterans Affairs Supportive Housing (VASH) receives no new vouchers in the president’s budget proposal.

Federal Budget Update

May.15.2017

President Trump signed the final FY 2017 budget May 5th, in the form of a bi-partisan supported omnibus spending package. HUD programs are funded from October 1, 2016 through September 30, 2017 at levels that will ensure that most key supportive housing programs will be sustained.

President Trump signed the final FY 2017 budget May 5th, in the form of a bi-partisan supported omnibus spending package. HUD programs are funded from October 1, 2016 through September 30, 2017 at levels that will ensure that most key supportive housing programs will be sustained.

“No one is going to be thrown out on the street,”

Apr.19.2017

HUD Secretary Ben Carson addressing the National Low Income Housing Coalition Policy Forum.

Two Network staff members traveled to Washington, D.C. on April 2nd-4th to participate in the National Low Income Housing Coalition Policy Forum and Lobby Day. The event convened more than 300 housing advocates for a series of panels on topics ranging from effective communication strategies to policies for long-term rental subsidies, as well as keynote speeches by HUD Secretary Ben Carson and Congresswoman Maxine Waters (D-CA-43).

Continue Reading …Federal Budget Update

Mar.20.2017

![]() On March 16th, President Trump released a budget blueprint that proposes $6.2 billion in cuts to HUD funding. Overall, these cuts represent a 13.2% decrease in funding compared to FY16 levels: the largest cuts in housing assistance since the Reagan administration, which ushered widespread homelessness. These cuts are unacceptable and we are committed to fighting them.

On March 16th, President Trump released a budget blueprint that proposes $6.2 billion in cuts to HUD funding. Overall, these cuts represent a 13.2% decrease in funding compared to FY16 levels: the largest cuts in housing assistance since the Reagan administration, which ushered widespread homelessness. These cuts are unacceptable and we are committed to fighting them.

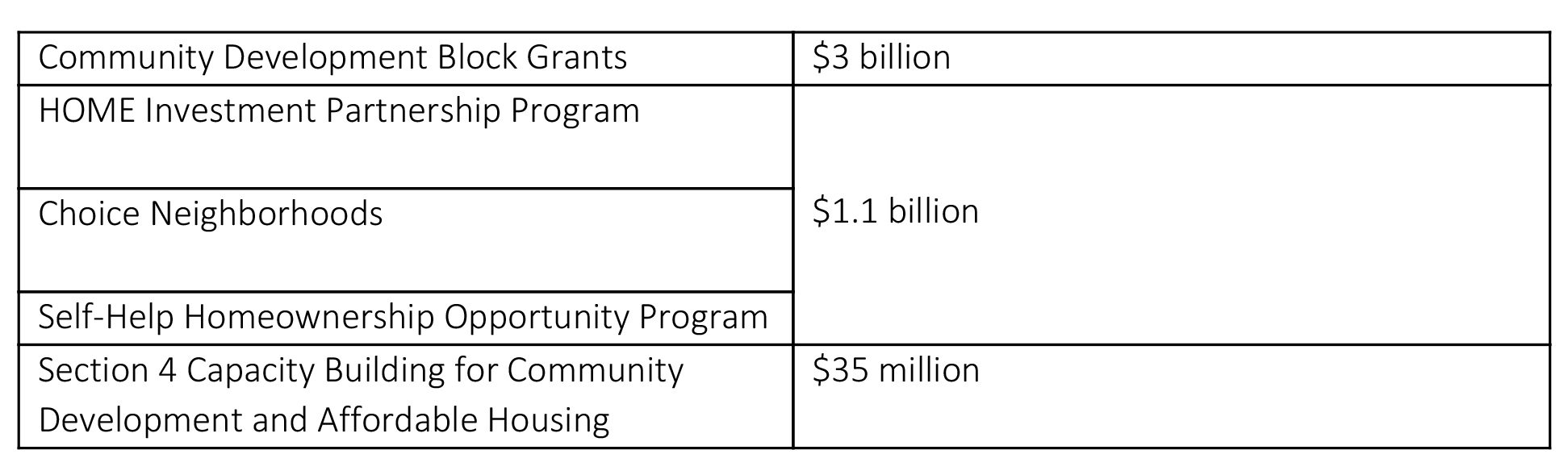

The Trump budget eliminates the following programs:

The HOME program is a critical resource for supportive housing in New York, serving as a capital subsidy for congregate developments, as well as providing rental assistance to the homeless. Nationwide, every $1 of HOME capital funding leverages $4.20 of additional local public and private funding. Community Development Block Grants (CDBG) fund cities and towns across the state for capital projects and programs benefiting low- and moderate-income New Yorkers.

The HOME program is a critical resource for supportive housing in New York, serving as a capital subsidy for congregate developments, as well as providing rental assistance to the homeless. Nationwide, every $1 of HOME capital funding leverages $4.20 of additional local public and private funding. Community Development Block Grants (CDBG) fund cities and towns across the state for capital projects and programs benefiting low- and moderate-income New Yorkers.